Shifting manufacturing to the US would subsequently require years if not a long time of coordinated funding in automation, instruments, infrastructure and coaching. Incentivising international part producers to construct services within the US would even be a problem.

“When you’re a Chinese language provider making a sure type of part that may also be utilized in a Huawei or a Xiaomi telephone, you’ve acquired leverage,” Mohan says. “The inducement to separate these factories is low, since you are getting scale and effectivity in China that you just wouldn’t get if Apple was your sole provider.”

Coverage uncertainty is one other downside, in response to Tsay. “The American system because it stands, the place every little thing can utterly flip-flop each 4 years, is just not conducive to enterprise funding. When individuals and corporations make investments, they should have an extended horizon than that.”

Mark Randall was senior vice chairman at Motorola when it was owned by Google and trying to construct its US smartphone manufacturing unit. The thought was not unimaginable, he says, however “I simply knew it was going to be extremely onerous”.

The US labour prices required to remodel uncooked supplies into completed items are “considerably greater” than elsewhere, he says. The US, for instance, has a scarcity of mechanical tooling engineers. For a large shift of electronics manufacturing to the US, “we’re speaking about needing tens of hundreds of them.”

Tariffs create a “nightmare” when modelling the prices of a brand new plant, Randall provides. “This is the reason most corporations don’t make short-term, knee-jerk reactions to the kind of adjustments that we’re seeing at the moment. You’ve acquired to be tremendous strategic and know the place you’re going in the long run.”

Made within the USA?

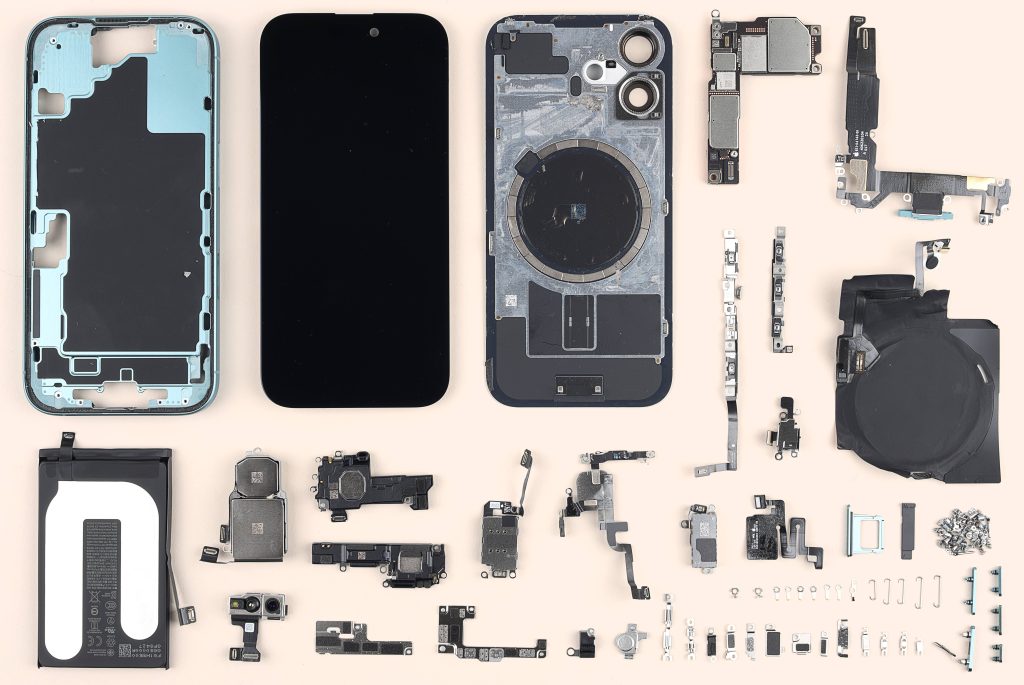

A deeper look at the provide chain for three components in the newest iPhone fashions illustrates the complexities of transferring manufacturing to the US, in an business that requires years to make even incremental shifts.

The one part within the touchscreen presently made in America is the duvet, produced by Apple’s long-standing glassmaker Corning in Kentucky, although the corporate additionally has services in China and India.

However the OLED show that helps protect battery life and an built-in multi-touch layer that permits on-screen interplay are principally produced by Samsung in South Korea.

The core digital components that make the display purposeful are mixed with the show unit at manufacturing services in China, earlier than this part is transported to a Foxconn plant to be mixed with the remainder of the iPhone.

The steel body neatly captures the problem of eradicating China from Apple’s provide chain. For most fashions, the casing is minimize and formed from a block of aluminium utilizing high-precision pc numerical management (CNC) machines.

Wayne Lam, an analyst at TechInsights, says the method depends on an “military” of those machines, which Apple’s distributors in China have spent years amassing and which can’t presently be reproduced elsewhere. “If Apple had been to onshore iPhone manufacturing, there wouldn’t be sufficient CNC machines they will buy to satisfy the dimensions of the China ecosystem,” he says.

Lam provides: “This can be a specialised ability that’s subsequent to unimaginable to duplicate exterior of China.”

Even the iPhone’s easiest part — its miniature screws — are complicated. They are made from completely different supplies relying on their function, and have a quantity of heads: philips, flat, tri-tip and pentalobe, amongst others.

However it’s the screwing in course of that sums up the challenges the corporate would face if iPhone manufacturing was moved to the US. Apple’s design, completely different from many different smartphone manufacturers, doesn’t use glue to connect the body, and analysts say that it’s presently cheaper for Foxconn to rent individuals to do the screwing than to put money into robotic options.