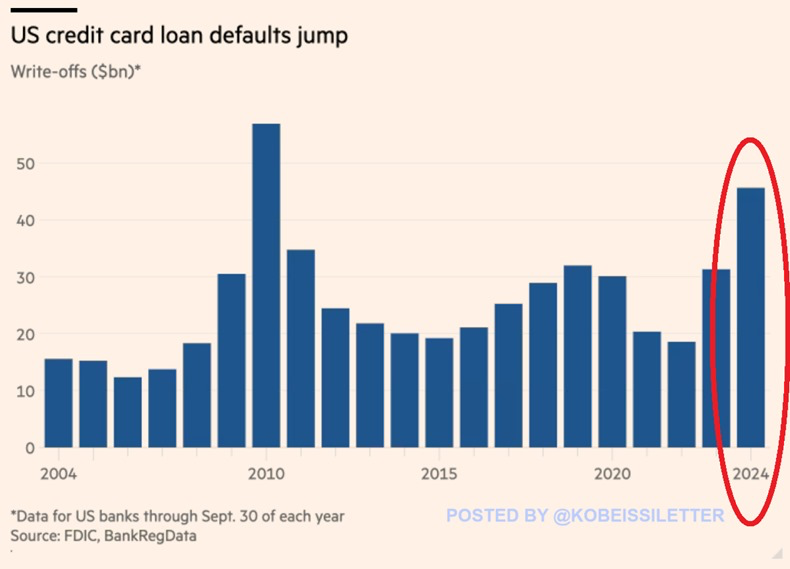

Bank card defaults within the US skyrocketed by 50% up to now 12 months. Bank card defaults reached $46 billion within the first 9 months of 2024, a stage not seen since 2010. The price of dwelling has merely surpassed manageable ranges for almost all of households.

People are feeling the affect of inflation and compounding curiosity. The New York Federal Reserve discovered that bank card debt hit a report excessive in September 2024 after surpassing $1.17 trillion throughout Q3. The Fed additionally reported that family debt reached a excessive of $17.94 trillion, with mortgages ($12.59 trillion), autos ($1.64 trillion), and pupil debt ($1.61 trillion) composing many of the debt. Family debt has been rising for the previous ten consecutive years, however now, the debt is just uncontrolled.

As of December 2024, the common APR was 24.43%. Purchase now, pay later strategies have seen an uptick lately. Donald Trump has proposed capping curiosity at 10%, a stage not seen because the early 90s. Client debt has by no means been larger and numerous households have fallen right into a snowball state of affairs the place they merely accumulate extra debt in a failed try to repay the previous.

Banks are naturally in opposition to this cover. These in disagreement imagine banks will probably be reluctant to lend and tighten their necessities. To some extent, that is probably not a damaging. Dwelling inside your means has fully modified underneath Bidenomics and everyone seems to be adjusting to the brand new price of dwelling. Within the meantime, folks must catch as much as get again on their ft earlier than the debt vortex sucks them right into a gap that turns into almost inconceivable to climb out of.

Customers have been compelled to pay for fundamental requirements on credit score as a result of astounding rise in costs for fundamentals like vitality, meals, and lease. “Whereas working People catch up, we’re going to place a brief cap on credit-card rates of interest,” Trump stated on the rally in New York. “We will’t allow them to make 25 and 30 %.” Now, Trump is proposing a brief cap. We allow numerous stimulus packages that by no means stimulate the financial system and hand out funds recklessly to assist these on exhausting occasions. But, nobody has proposed quickly capping bank card charges to provide shoppers time to repay their money owed. The banks are nonetheless profiting, albeit much less.

People are drowning in debt and the White Home can now not ignore this heightening disaster. The banks could also be in opposition to a cap, however completely nobody will receives a commission if this debt is distributed to collectors. Sadly, Trump’s tariff proposal will solely steepen shopper prices if applied. The Fed should cease mendacity to the general public about inflation as necessities like shelter and meals proceed to rise. Bidenomics by no means addressed these points and have allowed them to snowball right into a full-on disaster. As soon as upon a time, a person might work a good job, afford a house, household, and save for retirement comfortably. Now, dual-income households are working to barely keep afloat and drowning in debt for financing the necessities. It’s time to give attention to America and restore this nation to permit folks to have a good high quality of life.