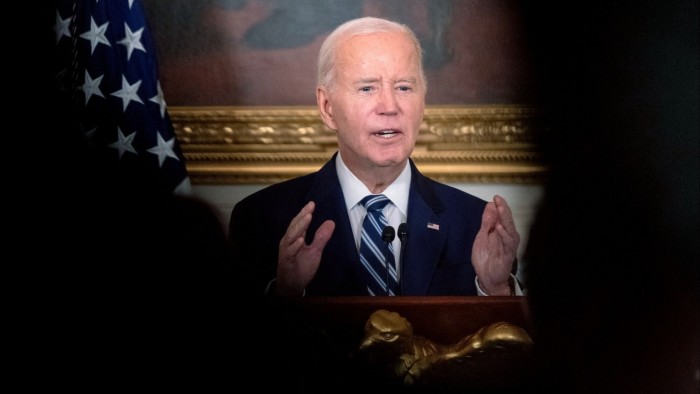

Welcome again to Commerce Secrets and techniques and all good needs for 2025. Although I’ve lengthy been too humble to make agency predictions in such a chaotic world, I used to be at the least going to do the regulation “what to look at for within the yr forward” at present. However with President Joe Biden final week blocking the Japanese firm Nippon Metal’s bid for US Metal, I really feel moved to carry out a requiem for friendshoring, that deserted orphan of Bidenomics. So my information to 2025 will come subsequent week. Charted Waters is on US inventory costs. My query for you this week: I made a tentative prediction that 2025 would finish with Donald Trump having put tariffs of at the least 10 per cent on at the least half of US imports. Will I be proper? E-mail me at alan.beattie@ft.com.

A nasty concept . . .

It wasn’t precisely completely unpredictable — a few of us predicted it — that “friendshoring”, also called “allyshoring”, the act of steering commerce and funding to geopolitically like-minded nations, would battle on two fronts. One, deciding which countries were friends. Two, and extra importantly, competing with the myriad other conflicting goals of Biden’s commerce and industrial coverage, together with however not restricted to creating manufacturing jobs at dwelling, establishing a US lead in high-tech sectors, selling the inexperienced transition and propping up America’s metal trade.

Nonetheless, a few of us have been additionally reasonably hopeful that Biden’s lengthy historical past as an alliance-builder in worldwide relations may weigh moderately closely within the stability. That’s the place we have been largely unsuitable. When it got here all the way down to it, steelmakers have been prioritised above all. As a unionised trade positioned in electoral swing states (Pennsylvania and Wisconsin) with tariff safety inherited from Donald Trump and national security and environmental rationales, nonetheless specious, they ticked too many containers to disregard.

True sufficient, Biden did droop the metal and aluminium tariffs of 25 per cent and 10 per cent respectively on imports from the EU, however solely briefly and in return for an advanced quota system that left European exporters struggling to entry the US market anyway. That truce will expire in March, and also you’d be extremely optimistic to think about that Trump will fortunately prolong it with out in search of extra concessions — or simply slapping the total tariffs again on it doesn’t matter what.

And now, although we’re virtually on the eve of the Trump administration and Kamala Harris misplaced Pennsylvania within the election, Biden has determined to ship another symbolic strike in favour of the metal trade by blocking Nippon Metal’s takeover of US Metal. The choice had cut up the inter-agency screening body Cfius (the Committee on Overseas Funding in america) and went towards the recommendation of a number of of his administration’s most senior officials.

. . . that doesn’t even make sense

I say “symbolic” as a result of the really weird factor about this resolution is that it doesn’t even make sense on his phrases, as Nippon Metal and the Japanese authorities have pointed out. The administration of US Metal is in favour of the deal, saying they want the funding that Nippon’s cash will convey. Officials from the local branch of the USW steelworkers’ union are in favour of the deal, saying it’s going to protect jobs. The Treasury, Pentagon and state division — the companies truly charged with preserving nationwide safety — didn’t object to the deal when it got here earlier than Cfius.

The principle objectors have been Katherine Tai, the US commerce consultant, and Dave McCall, the president of the USW, who has are available for some pretty choice public criticism. The USW management has lengthy been near Cleveland-Cliffs, a rival firm that has tried to take over US Metal.

All politics is native, together with commerce politics, however the politics right here is sort of bizarre. It’s surreal that the geopolitically essential apply of friendshoring is being sabotaged by a USTR with no specialism in nationwide safety and a union chief each appearing in defiance of colleagues who’re nearer to the problems at hand. Tai’s obsession with the metal trade has prolonged to sending teams of USTR officers on tourist trips to do photo-ops with steelworkers. That is vibes-based commerce coverage backed up by show-and-tell.

In contrast, the chief proponent of friendshoring within the administration was Treasury secretary Janet Yellen, and it’s notable that her division was engaged in one of many administration’s most vital efforts within the space. Congress handed the Inflation Discount Act in 2022 with its notorious native content material necessities for tax credit to purchase electrical autos. But it surely was the Treasury, via its stewardship of the IRA’s implementation, which cleverly managed to punch holes in these guidelines to permit European and Japanese automotive producers to profit by leasing vehicles moderately than promoting them.

Profitable historic episodes of utilizing commerce to make and preserve international coverage buddies have concerned dealing with down home opposition. The Marshall Plan after the second world struggle and the creation of an outward-looking transatlantic international coverage concerned defeating the isolationist tendency in US politics. Ronald Reagan’s administration took very robust motion towards specific imports from Japan (vehicles and semiconductors) however didn’t cease Japanese carmakers’ international direct funding within the US. It additionally drove ahead the Uruguay Spherical of commerce talks and created the World Commerce Group.

When it got here to it, it wasn’t the substance however the vibe of defending the metal trade that prevented the Biden administration giving friendshoring a good go. It’s a tragic finish for a good however finally unloved concept.

Charted waters

Regardless of all the things (or at the least regardless of all the things that’s come to this point) US shares have outperformed those of other big economies.

Commerce hyperlinks

Geoffrey Gertz on the Heart for a New American Safety think-tank says that the “small yard, excessive fence” mantra for US export controls on expertise was one other Biden administration geoeconomics concept that didn’t carry out nicely.

A Wall Avenue Journal evaluation posits that China has limited capacity to hit again at any tariffs imposed by Trump.

In a somewhat contrasting argument, Evan Medeiros, a former senior official in Barack Obama’s administration, argues within the FT that China can not solely retaliate but additionally adapt and diversify in response to Trump.

Eric Boehm within the libertarian journal Cause lays out the function performed by environmentalists in blocking the Nippon Metal-US Metal deal.

A member of Workforce “No person Is aware of Something”, FT markets legend Katie Martin says that traders have no clue what Trump goes to be as much as, leaving them “blindfolded and tiptoeing round rakes”.

Writing in Foreign Affairs, Daniel Rosen, Reva Goujon and Logan Wright of the Rhodium Group consultancy argue that China’s financial slowdown has tipped the stability of energy in commerce disputes in the direction of the US.

Commerce Secrets and techniques is edited by Jonathan Moules