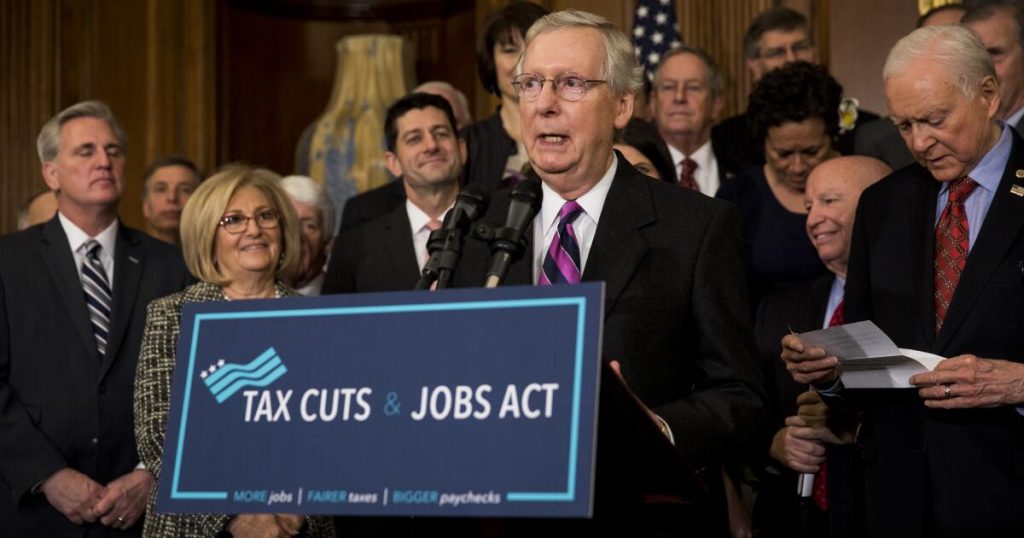

America approaches a vital juncture. Many provisions of the Tax Cuts and Jobs Act of 2017 are set to run out this yr. Congress may allow them to lapse, however that may imply a big, economically damaging tax hike for many People. Lawmakers may make all of the cuts everlasting, however with out income offsets that may deepen the nation’s disastrous debt load.

There’s a extra focused and accountable approach to take care of this fiscal dilemma.

It’s a standard, politically fueled mistake to speak about reducing taxes with out additionally speaking about our fiscal scenario. We’re $37 trillion in debt — happening $59 trillion in a decade — and after years of alarming development, the annual spending deficit is roughly $2 trillion. We additionally should grapple with the looming entitlement disaster, and curiosity funds on authorities debt are the fastest-growing finances merchandise. Instances are altering, making fiscal accountability extra essential than ever.

Whereas the upfront price of the tax cuts again in 2017 was $1.5 trillion, on paper, to make them everlasting may price $4.6 trillion. The precise price ought to be cheaper, as projections underestimate a possible improve in taxable revenue, funding and development. However we shouldn’t deny that there’s a important price.

There are additionally loads of classes to be discovered from the 2017 reform. The primary is that not all tax cuts are equally pro-growth. As such, we should always make everlasting solely essentially the most pro-growth provisions and permit others to run out or be prolonged on a short-term foundation.

To the extent that the 2017 cuts spurred development and better income, that was principally the product of the everlasting discount of the company tax price from 35% to 21%. This supplied companies with long-term certainty, encouraging funding, capital formation and wage development. In contrast to momentary tax cuts, which result in short-term boosts however create uncertainty, a everlasting decrease price lets companies plan, broaden operations and improve productiveness.

Paired with the soon-to-expire provision that enables companies to fully expense their investments, the everlasting company cuts attracted extra home and international funding, resulting in increased financial output and job creation over time.

A brand new Hoover Establishment study reveals that companies are extra aware of company tax modifications than beforehand thought. Analyzing the 2017 cuts, Kevin Hassett (the Nationwide Financial Council’s new director), Jon Hartley and Josh Rauh discovered {that a} one-percentage-point discount in the price of capital can enhance funding charges by as much as 2.4%, surpassing earlier estimates.

Congress ought to therefore prioritize making full expensing of capital funding everlasting. It may additionally lengthen it to investments in constructions.

Equally, the cuts to people’ tax charges ought to be made everlasting. This provision encourages work, financial savings and investments, particularly for prime earners, fostering a extra dynamic and resilient financial system. Latest research by Rauh and Ryan Shyu on California tax will increase exhibits how way more delicate high-income filers are to price modifications than most analysis usually assumes. The economists checked out taxpayers’ responses after Proposition 30 elevated marginal tax charges by as much as three share factors for high-income households. An additional 0.8% of those taxpayers left the state consequently, and people who stayed decreased taxable revenue, eroding as much as 61% of anticipated income inside two years. This sensitivity to excessive tax charges and our progressive federal tax code imply that letting particular person tax cuts expire can have an even bigger affect than projected, and increasing them can have a smaller deficit affect than most worry.

Whereas the economics are simple, congressional guidelines are usually not. Price range reconciliation is a particular course of permitting Congress to go tax, spending and debt-related payments with a easy Senate majority, bypassing the filibuster. Nevertheless it’s restricted to budgetary issues by the Byrd Rule and can’t improve the deficit past a 10-year window with out offsets.

That leads us to the second lesson: Legislators ought to make everlasting the 2017 measure’s revenue-raising provisions and lower some spending as properly.

Extending the boundaries placed on the state and native tax (SALT) deduction and mortgage curiosity deduction, and the elimination of the non-public exemption (a $4,050-per-household-member exclusion from taxable revenue) would generate important income — greater than masking the price of essentially the most growth-oriented tax cuts. Congress additionally must take away different tax breaks akin to the company SALT deduction, vitality subsidies and incentives for stadiums, simply to call just a few, and lower different spending to make it work.

Lastly, all the opposite, costlier and fewer pro-growth (although fashionable) provisions ought to be prolonged on a short lived foundation. These embody the Youngster Tax Credit score growth, the bigger commonplace deduction and various minimal tax reductions, which might be set to run out in just a few years as an alternative of being made everlasting. That will assist handle deficits whereas giving time for Congress to debate every one.

An analogous strategy may apply to Trump’s proposed new tax breaks on ideas, extra time pay and Social Safety advantages, which aren’t pro-growth and will cost $5 trillion over a decade.

A one-vote Republican Home majority makes the method of extending the tax cuts even by way of reconciliation difficult. Setting strict priorities and tips ought to assist get the job accomplished. Nevertheless, the important thing to success might be supporting development of the financial system with out ballooning the deficit and the debt.

Veronique de Rugy is a senior analysis fellow on the Mercatus Middle at George Mason College.