In mid-January, a high United States supplies firm introduced that it had began to fabricate uncommon earth magnets. It was essential information—there are not any giant U.S. makers of the neodymium magnets that underpin enormous and vitally essential business and protection industries, together with electric vehicles. Nevertheless it created barely a ripple throughout a very loud and stormy time in U.S. commerce relations.

The press launch, from MP Materials, was gentle on particulars. The corporate disclosed that it had began producing the magnets, known as neodymium-iron-boron (NdFeB), on a “trial” foundation and that the manufacturing unit would start steadily ramping up manufacturing earlier than the top of this 12 months. In accordance with MP’s spokesman, Matt Sloustcher, the power could have an preliminary capability of 1,000 tonnes each year, and has the infrastructure in place to scale as much as 2,000 to three,000 tonnes per 12 months. The discharge additionally mentioned that the power, in Fort Price, Texas, would provide magnets to General Motors and different U.S. producers.

NdFeB magnets are essentially the most highly effective and useful sort. They’re utilized in motors for electric vehicles and for heating, ventilating, and cooling (HVAC) techniques, in wind-turbine mills, in instruments and appliances, and in audio audio system, amongst different gear. They’re additionally important parts of numerous military systems and platforms, together with fighter and bomber plane, submarines, precision guided weapons, night-vision techniques, and radars.

A magnet manufacturing surge fueled by Protection {dollars}

MP Supplies’ has named its new, state-of-the-art magnet manufacturing facility Independence.Enterprise Wire

The Texas facility, which MP Materials has named Independence, is just not the one main rare-earth-magnet mission within the U.S. Most notably, Vacuumschmelze GmbH, a magnet maker primarily based in Hanau, Germany, has begun setting up a plant in South Carolina by a North American subsidiary, e-VAC Magnetics. To construct the US $500 million manufacturing unit, the corporate secured $335 million in exterior funds, together with at the very least $100 million from the U.S. authorities. (E-VAC, too, has touted a provide settlement with Basic Motors for its future magnets.)

In one other intriguing U.S. rare-earth magnet mission, Noveon Magnetics, in San Marcos, Texas, is at the moment producing what it claims are “business portions” of NdFeB magnets. Nonetheless, the corporate is just not making the magnets in the usual manner, beginning with metallic alloys, however somewhat in a novel course of primarily based on recycling the supplies from discarded magnets. USA Rare Earth announced on 8 January that it had manufactured a small quantity of NdFeB magnets at a plant in Stillwater, Oklahoma.

Yet one more firm, Quadrant Magnetics, introduced in January, 2022, that it will start development on a $100 million NdFeB magnet manufacturing unit in Louisville, Kentucky. Nonetheless, 11 months later, U.S. federal brokers arrested three of the company’s top executives, charging them with passing off Chinese language-made magnets as domestically produced and giving confidential U.S. army information to Chinese language companies.

The a number of US neodymium-magnet tasks are noteworthy however even collectively they received’t make a noticeable dent in China’s dominance. “Let me offer you a actuality verify,” says Steve Constantinides, an IEEE member and magnet-industry advisor primarily based in Honeoye, N.Y. “The whole manufacturing of neo magnets was someplace between 220 and 240 thousand tonnes in 2024,” he says, including that 85 % of the entire, at the very least, was produced in China. And “the 15 % that was not made in China was made in Japan, primarily, or in Vietnam.” (Different estimates put China’s share of the neodymium magnet market as excessive as 90 %.)

However take a look at the figures from a distinct angle, suggests MP Supplies’s Sloustcher. “The U.S. imports simply 7,000 tonnes of NdFeB magnets per 12 months,” he factors out. “So in whole, these [U.S.] services can supplant a big share of U.S. imports, assist re-start an {industry}, and scale because the manufacturing of motors and different magnet-dependent industries” returns to the USA, he argues.

And but, it’s laborious to not be slightly awed by China’s supremacy. The nation has some 300 producers of rare-earth permanent magnets, in accordance with Constantinides. The biggest of those, JL MAG Rare-Earth Co. Ltd., in Ganzhou, produced at the very least 25,000 tonnes of neodymium magnets final 12 months, Constantinides figures. (The corporate lately introduced that it was constructing one other facility, to start working in 2026, that it says will carry its put in capability to 60,000 tonnes a 12 months.)

That 25,000 tonnes determine is akin to the mixed output of all of the rare-earth magnet makers that aren’t in China. The $500-million e-VAC plant being inbuilt South Carolina, for instance, is reportedly designed to supply round 1,500 tonnes a 12 months.

However even these numbers don’t totally convey China’s dominance of everlasting magnet manufacturing. The place ever a manufacturing unit is, making neodymium magnets requires provides of rare-earth metallic, and that just about all the time leads straight again to China. “Although they solely produce, say, 85 % of the magnets, they’re producing 97 % of the metallic” on the earth, says Constantinides. “So the magnet producers in Japan and Europe are extremely depending on the rare-earth metallic coming from China.”

MP’s Mine-to-Manufacturing stragegy

And there, at the very least, MP Materials might have an attention-grabbing edge. Hardly any companies, even in China, do what MP is making an attempt: produce completed magnets beginning with ore that the corporate mines itself. Even giant corporations usually carry out only one or at most two of the 4 main steps alongside the trail to creating a rare-earth magnet: mining the ore, refining the ore into rare-earth oxides, decreasing the oxides to metals, after which, lastly, utilizing the metals to make magnets. Every step is a gigantic enterprise requiring solely completely different gear, processes, information, and talent units.

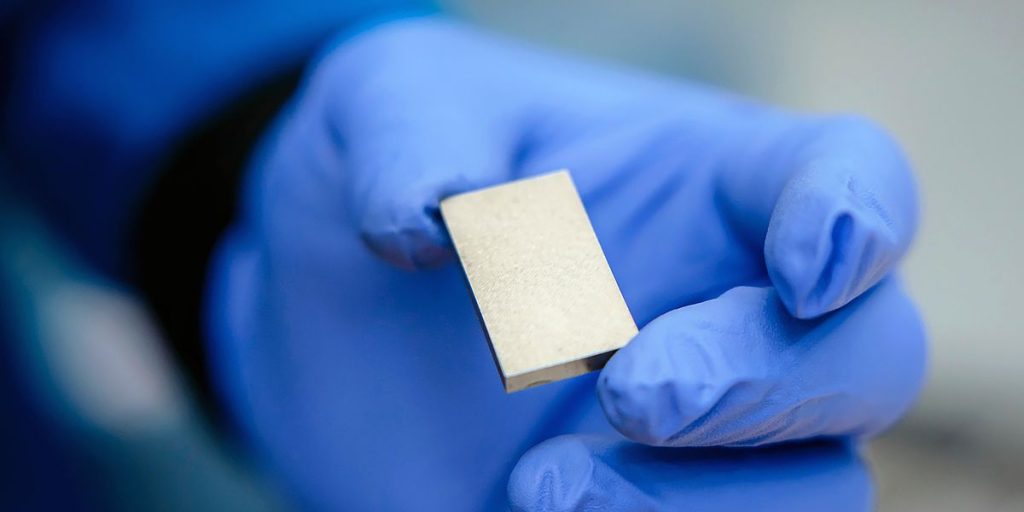

The rare earth metal produced at MP Supplies’ magnet manufacturing facility in Fort Price, Texas, consists of principally neodymium and praseodymium.Enterprise Wire

The rare earth metal produced at MP Supplies’ magnet manufacturing facility in Fort Price, Texas, consists of principally neodymium and praseodymium.Enterprise Wire

“The one benefit they get from [doing it all] is that they get higher insights into how completely different markets are literally rising,” says Stan Trout, a magnet {industry} advisor in Denver, Colorado. “Getting the timing proper on any enlargement is essential,” Trout provides. “And so MP must be getting that data in addition to anyone, with the completely different vegetation that they’ve, as a result of they work together with the market in a number of other ways and might actually see what demand is like in actual time, somewhat than as some projection in a forecast.”

Nonetheless, it’s going to be an uphill climb. “There’s are a variety of each laborious and mushy subsidies within the supply chain in China,” says John Ormerod, an {industry} advisor primarily based in Knoxville, Tenn. “It’s going to be tough for a US producer to compete with the present worth ranges of Chinese language-made magnets,” he concludes.

And it’s not going to get higher any time quickly. China’s rare-earth magnet makers are solely utilizing about 60 % of their manufacturing capability, in accordance with each Constantinides and Ormerod—and but they’re persevering with to construct new vegetation. “There’s going to be roughly 500,000 tonnes of capability by the top of this 12 months,” says Ormerod, citing figures gathered by Singapore-based analyst Thomas Kruemmer. “The demand is just about 50 % of that.”

The upshot, the entire analysts agree, will probably be downward worth stress on rare earth magnets within the close to future, at the very least. On the similar time, the U.S. Department of Defense has made it a requirement that rare-earth magnets for its techniques have to be produced solely, beginning with ore, in “pleasant” international locations—which doesn’t embody China. “The DoD might want to pay a premium over cheaper imported magnets to determine a worth flooring enabling home U.S. producers to efficiently and constantly provide the DoD,” says Constantinides.

However is what’s good for America good for Basic Motors, on this case? We’re all going to search out out in a 12 months or two. For the time being, few analysts are bullish on the prospect.

“The automotive {industry} has been extraordinarily cost-conscious, demanding provider worth reductions of even fractions of a cent per piece,” notes Constantinides. And even the Trump administration’s tariffs are unlikely to change the fundamental math of market economics, he provides. “The applying of tariffs to magnets in an try to ‘stage the enjoying area’ incentivizes corporations to search out work-arounds, corresponding to exporting magnets from China to Malaysia or Mexico, then re-exporting from there to the USA. This isn’t theoretical, these work-arounds have been used for many years to keep away from even the previous or current low tariff charges of about 3.5 %.”

From Your Website Articles

Associated Articles Across the Net