BBC West Investigations

BBC

BBCA person who misplaced £1,000 price of instruments after being scammed by a faux banking app has stated it makes you “lose religion in humanity”.

The apps mimic official cellular banking platforms and permit fraudsters to faux financial institution transfers in individual, present the vendor a “profitable cost” message after which stroll away, leaving sellers hundreds of kilos out of pocket.

Dr Tim Day, lead in doorstep crime and scams for the Chartered Buying and selling Requirements Institute (CTSI), described the apps as an “rising risk.” He added: “The in-person nature of this rip-off is uncommon.”

Sufferer Anthony Rudd stated: “I discovered it completely sickening that you can look somebody within the eye, shake their hand, after which rob them.”

About 500 reviews of crimes involving faux banking apps have been made to Motion Fraud up to now three years.

A few of these apps have been out there on the Google Play retailer up to now however have been eliminated. Google stated the “security and safety of customers is our high precedence”.

Now, BBC West Investigations have discovered variations of the apps out there elsewhere on-line which will be downloaded on to Android telephones with out using an official app retailer.

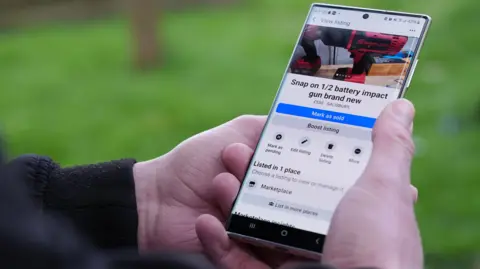

Mechanic Mr Rudd was promoting greater than £1,000 price of energy instruments on a social media platform when he acquired a message from a profile named Liam Wright.

When “Mr Wright” stated he was interested by viewing them, Mr Rudd invited him to come back to his workshop in Salisbury, Wiltshire.

After the person arrived, he checked over the instruments, provided a financial institution switch and opened what gave the impression to be a banking app.

“He handed his cellphone over to me and I typed in my account particulars, clicked ship, and it got here up with a profitable cost notification,” Mr Rudd stated.

“It seemed completely real.”

Whereas Mr Rudd was ready for the cash to look in his checking account, he turned his again to choose up equipment handy over as a part of the sale.

The scammer used this chance to depart with all of the instruments, however the cash by no means arrived in Mr Rudd’s checking account.

John Reddock

John Reddock“He got here into my office and took my instruments,” Mr Rudd stated.

“It angered me a lot that somebody could possibly be so brazen, however it’s additionally embarrassing that I allowed this to occur.”

Mr Rudd resigned from his job as a result of he stated the rip-off had “a huge effect” on his psychological well being.

“You lose religion in humanity, that somebody could possibly be that low,” he stated.

Wiltshire Police advised Mr Rudd it is not going to be taking any additional motion because it has been unable to determine the suspect for the reason that incident on 11 February.

John Reddock

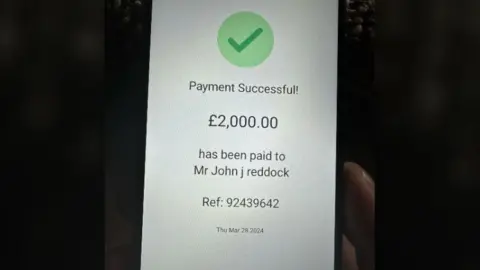

John ReddockIt was the same story for John Reddock, from Liverpool.

He was promoting a gold bracelet within the hope he might use the cash to take his two youngsters on vacation to Spain.

He additionally used a social media platform to promote the merchandise, which he listed for £2,000.

“I used to be making an attempt to do one thing good for my children and it backfired on me,” stated Mr Reddock.

Two males arrived at his home to view the bracelet and determined they have been completely satisfied to go forward with the acquisition, providing a financial institution switch.

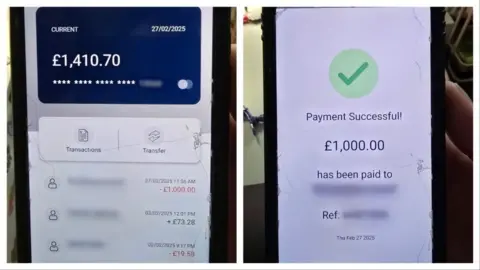

Mr Reddock advised them his checking account particulars and one in every of them typed it into what gave the impression to be a banking app on their cellphone.

It then confirmed a cost profitable notification.

John Reddock

John ReddockThey left with the bracelet however Mr Reddock by no means acquired the cash.

“It is given me nightmares and sleepless nights. I am disgusted about what they’ve completed to me,” he stated.

“It is made me actually indignant as a result of I used to be making an attempt to do one thing good for my children, they usually got here to my property to steal from me.”

Mr Reddock reported the incident to the police however no additional motion was taken.

John Reddock

John ReddockBBC West Investigations discovered the faux banking apps – which we aren’t naming in order to not promote them – can be found to obtain onto an Android cellphone straight from the web.

Dr Day stated: “A lot of fraud is now occurring on-line that it is simple to drop our guards when coping with individuals in individual.

“It provides us a false sense of safety however fraud and scams are simply as more likely to occur on this area.”

Dr Day stated it additionally exhibits how scams have gotten “extra complicated and complicated”.

“The amount of cash which is on the market because of fraud is so big and the relative ranges of enforcement doable means it is a crime sort which is attracting an increasing number of skilled criminals,” he added.

He stated that tech firms should be “extra engaged” in driving out fraud on on-line platforms.

Learn how to keep away from the rip-off

UK Finance represents greater than 300 corporations within the UK’s banking and monetary trade. A spokesperson stated the faux banking app rip-off is “a priority” they usually gave the next security recommendation:

- Don’t be pressured into accepting cost by financial institution switch

- By no means hand over items except you’re certain you may have acquired the cash and examine your personal checking account to see if the cost has arrived

- Test if the customer has a newly registered profile earlier than you meet them as this will imply they aren’t who they are saying they’re

Extra details about staying protected from scams can be found here.

However that is of little consolation to Sebastian Liberek, who runs his enterprise Seb’s Repairs in Gloucester.

He sells and repairs telephones, tablets and computer systems and has been focused by fraudsters – who walked straight into his store – utilizing faux banking apps on three events in current months.

He stated he has misplaced tons of of kilos to a financial institution switch faked by a buyer.

“It makes you are feeling indignant and weak,” Mr Liberek stated.

“If you’ve spent 15 years constructing a enterprise and somebody can chip at it and take items away with out penalties.”

Mr Liberek has now put in additional safety measures similar to CCTV to guard his enterprise from future makes an attempt.

“The very fact it is occurred 3 times, it’s going to most likely occur a fourth time,” he stated.

“There’s nowhere to go, you can not discover them, you possibly can report them to police, however probabilities of something being completed about it are pretty slim.

“It is a scenario with out reply, or ending.”

A authorities spokesperson stated they have been taking “formidable steps to sort out the evolving risk of fraud”.

“Within the coming months, we’ll set out additional particulars together with plans to strengthen worldwide cooperation, introduce higher protections towards AI-enabled fraud, and enhance collaboration between authorities and the personal sector,” they added.

Get our flagship e-newsletter with all of the headlines it’s essential to begin the day. Sign up here.