Unlock the White Home Watch publication totally free

Your information to what the 2024 US election means for Washington and the world

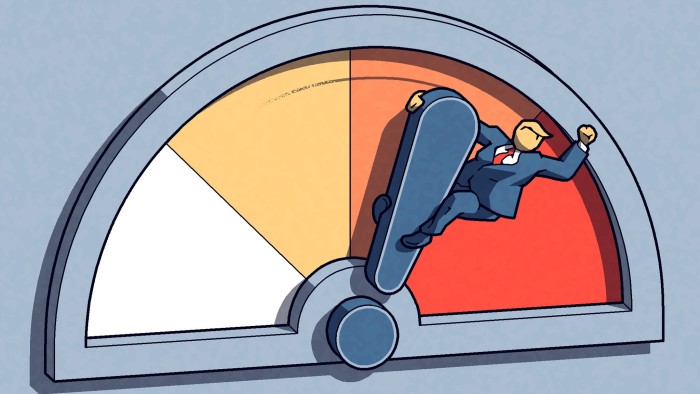

America underneath Donald Trump is an rising market. That’s my takeaway from the previous couple of days of tariff chaos and its fallout.

After I first raised this concept last October, I identified that rising markets are sometimes characterised by unsure economics, corrupt politics, establishments which might be too weak to implement democratic norms, violence and social polarisation. The US has been heading quick in that route since 2016, for causes we all know all too nicely, although asset costs and borrowing charges hadn’t but mirrored it.

As a substitute, we often noticed US equities and forex rising during times of political and financial stress between 2016 and 2024, because of the haven standing of the greenback.

It didn’t appear to matter that every one the issues that had bolstered American firms, from low charges to monetary engineering to globalisation itself, had been tapped out. US asset markets appeared impervious to the notion of a dollar-doomsday state of affairs that might ship each forex and asset costs tumbling.

Trump has lastly ended America’s exorbitant privilege. The president’s erratic management fashion, which jogs my memory of the man who pulls off his steering wheel in order that the opposite driver will likely be pressured to swerve, is now endangering his nation’s forex and fairness values, as has all the time been the case in different, non-exceptional political economies with this a lot turmoil.

As Mark Rosenberg, the founder and co-head of analysis on the analysis agency GeoQuant, identified final week, “we now see robust, rising market-level damaging correlations between political danger, and each the USD and S&P 500”.

This isn’t a shock, although many within the enterprise and funding group have acted as if it must be. Too many CEOs had been wanting solely at the potential for tax cuts and deregulation in Trump’s second time period reasonably than the broader instability and financial paradigm shift that it heralded.

Trump’s private behaviour definitely despatched loads of rising market-like indicators. Is there something extra EM than a frontrunner who surrounds himself with lieutenants vetted primarily for absolute loyalty? The extra management is about cult of persona, the extra financial outcomes are decided by the person ruler, who may give and take with impunity. And the weaker the establishments, the extra probably it’s that the ruler will get away with it.

Trump’s election was “in some ways a product of the rising market-like traits in social and institutional stability within the US that we’ve seen rising since 2017”, notes Rosenberg.

Nonetheless, it took the specter of financial battle on allies and adversaries alike, waged in ways in which left even Trump’s personal policymakers struggling to maintain up, to shift danger perceptions. Poor US commerce consultant Jamieson Greer was in Congress defending tariffs whilst Trump was granting a 90-day reprieve to many nations. Who will take him, or any of Trump’s cupboard, significantly in any future negotiation?

Fairness markets, at the least till final week, acted as if Trump had some management over the state of affairs he unleashed. When the president posted that it was a “nice time to purchase” shares, they rose. That too is EM-like behaviour. I keep in mind again in 2008, when Russia’s then prime minister Vladimir Putin spoke 5 sentences criticising a coal and metal oligarch, and $6bn was wiped off the corporate’s worth in actual time. In Turkey, the lira and different belongings transfer considerably on President Recep Tayyip Erdoğan’s speeches and pronouncements.

However the bond market is aware of higher, and it has for a while been telling us what equities didn’t, which is that borrowing charges aren’t happening, and political danger isn’t going away. Whilst equities loved the post-election “Trump bump,” yields remained elevated. The truth that bonds, normally a haven, additionally bought off throughout final week’s fairness market rout tells us that buyers had been both promoting much less dangerous belongings to cope with losses elsewhere, or that belief within the US and its future is just gone.

In reality, final week could also be remembered because the true, quantifiable starting of the tip of American financial exceptionalism. “Concern exists throughout,” Euronext chief govt Stéphane Boujnah informed France Inter radio just a few days in the past. “The nation [United States] is unrecognisable and we live in a transition interval. There’s a sure type of mourning, as a result of america that we had recognized for probably the most half as a dominant nation resembled the values and establishments of Europe and now resembles extra an rising market.”

I think that will likely be true underneath Trump with or with out tariffs. Even when China backs down and humours the president (I don’t suppose it’ll), or we find yourself with solely reasonable shifts to the worldwide buying and selling system, the harm has been finished. Belief is gone. Wall Avenue and Primary Avenue alike are uneasy, and that modifications behaviour.

The capriciousness of Caligula capitalism goes to be with us at the least till the midterms (I’m personally planning to be in money and gold until then). However the legacy will linger for much longer, significantly because the Trump tax cuts coming down the pike in just a few months create a very unsustainable debt image. Is it potential that America might change into the epicentre of the subsequent rising market-style debt disaster? I might have dominated it out as soon as. Not any extra.