On the evening of Feb. 21, Ben Zhou, the chief government of the cryptocurrency trade Bybit, logged on to his pc to approve what gave the impression to be a routine transaction. His firm was transferring a considerable amount of Ether, a preferred digital forex, from one account to a different.

Thirty minutes later, Mr. Zhou bought a call from Bybit’s chief monetary officer. In a trembling voice, the manager instructed Mr. Zhou that their system had been hacked.

“The entire Ethereum is gone,” he mentioned.

When Mr. Zhou accepted the transaction, he had inadvertently handed management of an account to hackers backed by the North Korean government, based on the F.B.I. They stole $1.5 billion in cryptocurrencies, the biggest heist within the trade’s historical past.

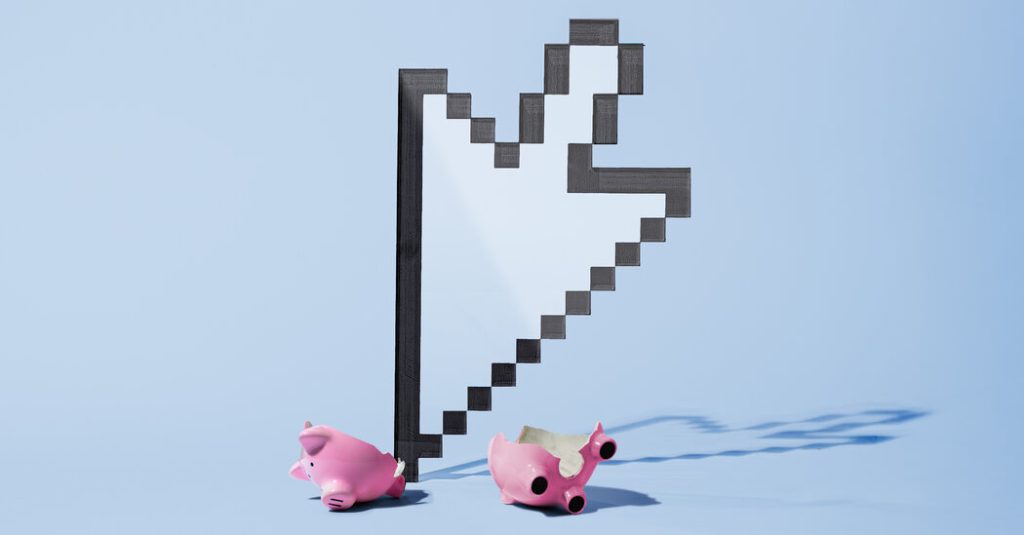

To tug off the astonishing breach, the hackers exploited a easy flaw in Bybit’s safety: its reliance on a free software program product. They penetrated Bybit by manipulating a publicly accessible system that the trade used to safeguard lots of of hundreds of thousands of {dollars} in buyer deposits. For years, Bybit had relied on the storage software program, developed by a expertise supplier referred to as Safe, at the same time as different safety corporations bought extra specialised instruments for companies.

The hack despatched crypto markets right into a free fall and undermined confidence within the trade at a vital time. Below the crypto-friendly Trump administration, trade executives are lobbying for brand spanking new U.S. legal guidelines and laws that might make it simpler for individuals to pour their financial savings into digital currencies. On Friday, the White Home is scheduled to host a “crypto summit” with President Trump and high trade officers.

Crypto safety consultants mentioned they had been troubled by what the heist revealed about Bybit’s security protocols. The losses had been “fully preventable,” one safety agency wrote in an evaluation of the breach, arguing that it “mustn’t have occurred.”

Secure’s storage instrument is extensively used within the crypto trade. However it’s higher suited to crypto hobbyists than exchanges dealing with billions in buyer deposits, mentioned Charles Guillemet, an government at Ledger, a French crypto safety agency that gives a storage system designed for corporations.

“This actually wants to vary,” he mentioned. “It’s not an appropriate scenario in 2025.”

At Bybit, the hack set off a frantic 48 hours. The corporate oversees as a lot as $20 billion in buyer deposits however didn’t have sufficient Ether readily available to cowl the losses from the $1.5 billion heist. Mr. Zhou, 38, raced to maintain the enterprise afloat by borrowing from different corporations and drawing on company reserves to satisfy a surge of withdrawal requests. On social media, he appeared surprisingly relaxed, saying a couple of hours after the theft that his stress ranges had been “not too bad.”

Because the disaster unfolded, the value of Bitcoin, a bellwether for the trade, plunged 20 p.c. It was the steepest drop because the 2022 failure of FTX, the trade run by the disgraced mogul Sam Bankman-Fried.

In an interview this week, Mr. Zhou acknowledged that Bybit had advance warning about potential issues with Secure. Three or 4 months earlier than the hack, he mentioned, the corporate observed the software program was not absolutely suitable with one in all its different safety providers.

“We should always have upgraded and moved away from Secure,” Mr. Zhou mentioned. “We’re undoubtedly trying to try this now.”

Rahul Rumalla, Secure’s chief product officer, mentioned in an announcement that his crew had created new safety features to guard customers and that Secure’s merchandise had been “the treasury spine for a number of the largest organizations within the house.”

“Our job is not only to repair what occurred,” Mr. Rumalla mentioned, “however to make sure all the house learns from it, so this doesn’t occur once more.”

Based in 2018, Bybit operates as a crypto market, the place day merchants {and professional} traders can convert their {dollars} or euros into Bitcoin and Ether. Many traders deal with exchanges like Bybit as casual banks, the place they deposit crypto holdings for safekeeping.

By some estimates, Bybit is the world’s second-largest crypto exchange, processing tens of billions of {dollars} every single day. Primarily based in Dubai, it doesn’t provide providers to clients in america.

On Feb. 21, Mr. Zhou was at residence in Singapore, ending up some work, he mentioned within the interview.

However first, he and two different executives wanted to log off on a switch of cryptocurrencies from one account to a different. These routine transfers are speculated to be safe: No single particular person at Bybit can execute them, creating a number of layers of safety from thieves.

Behind the scenes, nonetheless, a gaggle of hackers had already damaged into Secure’s system, based on Bybit’s audit of the hack. That they had compromised a pc belonging to a Secure developer, an individual with information of the matter mentioned, enabling them to plant malicious code to control transactions.

A hyperlink despatched through Secure invited Mr. Zhou to approve the switch. It was a ruse. When he signed off, the hackers seized management of the account and stole $1.5 billion in crypto.

The sudden outflows confirmed up on the blockchain, a public ledger of crypto transactions. Crypto analysts quickly identified the wrongdoer because the Lazarus Group, a hacking syndicate backed by the North Korean authorities.

That evening, Mr. Zhou went to Bybit’s Singapore workplace to handle the disaster. He introduced the hack on social media and began a disaster protocol identified on the firm as P-1, urgent a button to get up each member of the management crew

Round 1 a.m., Mr. Zhou appeared on a livestream on X, swigging a Purple Bull. He promised clients that Bybit was nonetheless solvent.

“Even when this hack loss will not be recovered, all of purchasers property are 1 to 1 backed,” he said in a put up. “We will cowl the loss.”

These assurances weren’t sufficient. Inside hours, Mr. Zhou mentioned, about half the digital currencies deposited on the platform, or near $10 billion, had been withdrawn. The crypto market plunged.

To restrict the harm, different crypto corporations provided to assist. Gracy Chen, the chief government of a rival trade, Bitget, lent Bybit 40,000 in Ether, or roughly $100 million, with out requesting any curiosity and even collateral.

“We by no means questioned their potential to pay us again,” Ms. Chen mentioned.

Between disaster conferences, Mr. Zhou supplied a operating commentary on X. He shared screenshots from a well being app, exhibiting his stress ranges had been surprisingly regular.

“Too targeted commanding all of the conferences. Forgot to emphasize,” he wrote. “I believe it can come quickly when i begin to actually grasp the idea of shedding $1.5B.”

After looting Bybit, the North Korean hackers unfold the stolen funds throughout an unlimited internet of on-line crypto wallets, a money-laundering technique that they’d additionally employed after different heists.

“Lazarus Group is on one other degree,” Haseeb Qureshi, a enterprise investor, wrote on X after the theft.

Safety consultants blamed Bybit for placing itself in danger. To authorize the routine switch that led to the hack, Mr. Zhou mentioned, he used a {hardware} instrument designed by Ledger, the crypto safety agency. The gadget was not in sync with Secure, he mentioned. So he couldn’t use the instrument to examine the complete particulars of the transaction he was approving, all the time a dangerous apply within the crypto world.

“Secure simply doesn’t provide the sorts of controls that you’d need for those who’re going to be often making operational transfers,” mentioned Riad Wahby, a pc engineering professor at Carnegie Mellon College and a co-founder of the digital safety agency Cubist.

Mr. Zhou mentioned he wished he had taken motion sooner to bolster Bybit’s defenses. “There’s quite a lot of regrets now,” he mentioned. “I ought to have paid extra consideration on this space.”

Nonetheless, Bybit continued working after the hack, processing all of the withdrawals inside 12 hours, Mr. Zhou mentioned. Not lengthy after the breach, he announced on X that the corporate was transferring round one other $3 billion in crypto.

“That is deliberate manoeuvre, FYI,” he wrote. “We aren’t hacked this time.”