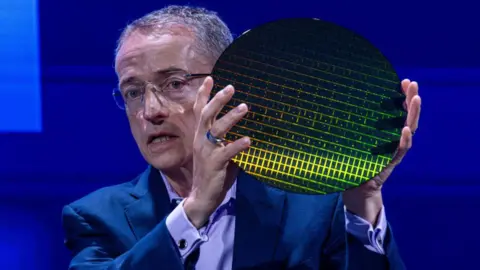

Getty Photos

Getty PhotosUS chip-maker Intel has stated it plans to chop greater than 15,000 job cuts because it seeks to revive the enterprise and meet up with rivals.

Shares within the firm plunged by as much as 20% after it introduced the measures, and likewise reported falling gross sales.

The information from Intel additionally hit different shares in different tech giants, and contributed to a pointy fall in Asian inventory markets.

Japan’s Nikkei share index closed down 5.8%, the most important share fall since March 2020 in the beginning of the pandemic, with Japanese tech corporations among the many greatest losers.

The Nikkei ended the day down 2,216.63 factors at 35,909.70, the second-biggest factors drop in its historical past, with worries in regards to the power of the US financial system additionally affecting shares.

A downbeat survey of US manufacturing corporations triggered fears the financial system is weakening, and has elevated curiosity within the newest US jobs figures which can be due out afterward Friday.

The three main share indexes within the US closed decrease on Thursday, and shares in huge names, together with Amazon, continued to fall in after-hours commerce.

Amazon shares dropped greater than 4%, after the e-commerce large reported a ten% rise in gross sales to $148bn.

That marked a slowdown from the prior quarter and it forecast additional weakening within the months forward, placing strain on margins, even because the agency ramps up investments in areas reminiscent of synthetic intelligence (AI).

‘Bolder actions’ wanted

Intel has been struggling as companies flip to rivals reminiscent of Nvidia, identified for its highly effective AI chips.

The corporate stated gross sales fell 1% year-on-year within the three months to June and warned that the second half of the yr can be worse than anticipated.

“Our revenues haven’t grown as anticipated – and we’ve but to completely profit from highly effective tendencies, like AI,” chief govt Pat Gelsinger wrote in a memo to staff.

He stated the state of affairs required “bolder actions” and the agency needed to “basically change the best way we function”.

Intel has slashed funding plans and likewise stated it might droop dividend funds.

“It is actually having to tug again on spending on its information centres and it’s struggling to take market from different suppliers, so it’s an actual shock to the market,” Lucy Coutts, funding director at JM Finn, advised the BBC.

There was higher information from Apple, which noticed gross sales rebound in spring, overcoming weak point in China and a dip in iPhone gross sales.

Revenues within the three months to June have been $85.8bn (£67.3bn), up 5% year-on-year and marking a return to progress after a stoop in the beginning of 2024.

Apple stated it was properly positioned to learn from the elevated use of AI, as AI-powered enhancements to the corporate’s software program persuade clients to improve their units.

The corporate lately launched a number of the new options, branded as “Apple Intelligence”, to builders within the US.

The brand new system makes it simpler for iPhone customers to file and transcribe telephone conversations, generate personalised emojis whereas messaging and work together extra conversationally with the corporate’s voice assistant, Siri, amongst different adjustments.

“We stay extremely optimistic in regards to the potentialities of AI and we’ll proceed to make vital investments on this expertise,” stated Apple boss Tim Cook dinner.

Over the April to June interval, gross sales of iPhones slipped 1%, a drop outweighed by elevated gross sales of Macs and iPads.

Apple additionally reported an all-time file in income from its companies division, which incorporates choices reminiscent of Apple Pay and Apple Information.