Unlock the White Home Watch e-newsletter totally free

Your information to what the 2024 US election means for Washington and the world

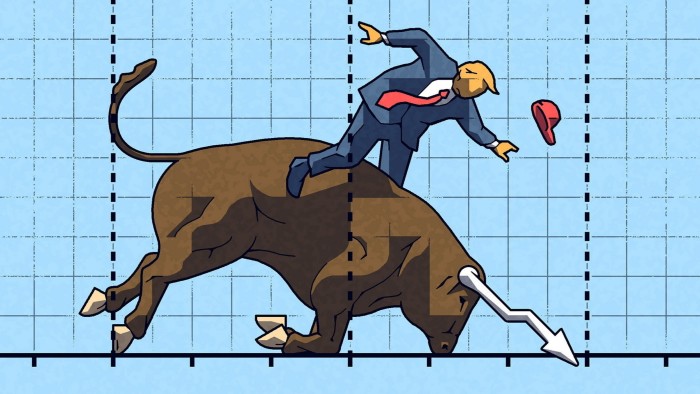

Name me a Cassandra. Many have. However I’m already dreading the downturn that should certainly come sooner or later throughout Donald Trump’s presidency. Sure, the short-term sugar excessive of deregulation and tax cuts is already upon us. However, judging by historical past, the US is method overdue for each a recession and a giant market correction, and the chance vectors in play with Trump make it extra possible.

Why ought to I be so destructive, so early? One can simply argue that there are lots of causes to be optimistic that the robust financial system President Joe Biden constructed and Trump will inherit will proceed to broaden. There’s optimistic actual revenue progress in the intervening time, plus productiveness enhancements, an anticipated restoration in world manufacturing and price cuts, after all.

Add to that issues akin to the approaching Trump deficit spending, and the roll again of Biden’s antitrust insurance policies, which is able to certainly imply a increase in mergers and acquisitions, and you’ve got a great case for one more 12 months or two of features in US property. This appears significantly so in areas like know-how, finance (banks are gearing up for all that dealmaking), crypto (each time the billionaire investor Elon Musk tweets about Dogecoin it will get a lift), personal fairness and personal credit score.

And but, even when the Democrat Kamala Harris had gained the White Home, I’d be considering rigorously about what’s actually driving this market. As TS Lombard mentioned in a latest word to purchasers, “this enterprise cycle has at all times appeared ‘synthetic’, and it has been powered by a collection of momentary or one-off forces, akin to pandemic reopening, fiscal stimulus, extra financial savings, revenge spending and extra lately [higher] immigration and labor power participation”.

Certainly, one might argue that the market setting of the previous 40 years, with its pattern of falling rates of interest and big bouts of financial stimulus and quantitative easing after the nice monetary disaster, is synthetic. Now we have a era of merchants who don’t know what a really excessive rate of interest setting seems like. The minute charges went up even just a bit bit just a few years again, you noticed the dominoes fall — think about Silicon Valley Bank’s bailout or the surge in bond yields throughout the disaster that ended Liz Truss’s very temporary stint as prime minister.

Whereas I don’t truly assume that Trump goes so as to add gasoline to any inflationary fireplace with huge across-the-board tariffs (the Wall Avenue contingent of his administration wouldn’t countenance the market collapse that may outcome), you’ll most likely see him use the US client market as a form of chit to be traded for varied financial and geopolitical features. Germany not falling according to America’s China coverage? How about increased tariffs on European autos? This sort of dealmaking is itself dangerous.

I very a lot doubt whether or not Trump will deport tens of millions of migrants, as he has promised to do; once more, the Wall Avenue crowd will push again on the inflationary results. However this elementary rigidity between what the Maga crowd needs, and what personal fairness and Large Tech need, is itself a hazard. It can inevitably create factors of instability and unpredictability which will transfer the markets a method or one other.

Surprising coverage divergences might simply mix with among the extra ordinary sources of economic danger to create a giant market occasion.

Extremely leveraged loans and personal fairness investments are a hazard after all, provided that Trump will most likely roll again an already lax regulatory setting at a time when these property have gotten an even bigger a part of the portfolios of pensions and retail traders.

This, coupled with an anticipated scaling again of financial institution capital will increase, is likely one of the issues that has Higher Markets president Dennis Kelleher fearful. “I feel we’ll get a two-year sugar excessive below Trump however down the street, we’re taking a look at a doubtlessly catastrophic correction — one thing a lot worse than [the financial crisis of] 2008. That’s as a result of now we have a monetary system that’s basically extractive.”

Crypto is one other potential set off. It might don’t have any inherent worth, however Columbia College regulation professor Jeffrey Gordon worries that as real-world property and liabilities are more and more denominated in crypto, it’ll have a channel into the true financial system. “Stablecoins can dive considerably beneath par,” Gordon says. “We’ve seen this film earlier than, with prime cash market funds.”

But when there’s a liquidity disaster in crypto, there isn’t a lender of final resort. You’d simply see lots of imaginary worth disappear, leaving real-world collateral calls and financing shortfalls.

I’d put Musk himself up there as one other monetary danger issue. The electrical-car maker Tesla is on a tear due to the tech titan’s relationship with Trump. However sooner or later, the markets are going to grasp that China could make its personal electrical autos for much lower than Tesla can. Past that, US-China tensions could but affect on Musk’s capacity to make inexperienced vehicles in China. I’d even be shocked if the massive American oil barons, who’re the true muscle within the Republican social gathering, didn’t push again towards Musk’s affect. Both method, Tesla’s inventory value might take a giant hit, and drag down the bigger froth in areas akin to synthetic intelligence with it.

As somebody nonetheless closely invested in US shares, I’m not wishing for any of this to occur. However I wouldn’t low cost it both. Washington today has a really roaring 20s vibe.